Prices vs Inflation 101

Theya is an app for simplified Bitcoin self-custody. With its 2-of-3 multisig custody solution, you can enjoy maximum security for your Bitcoin and the peace of mind that comes with it.

Download Theya on the App Store and declare your sovereignty today.

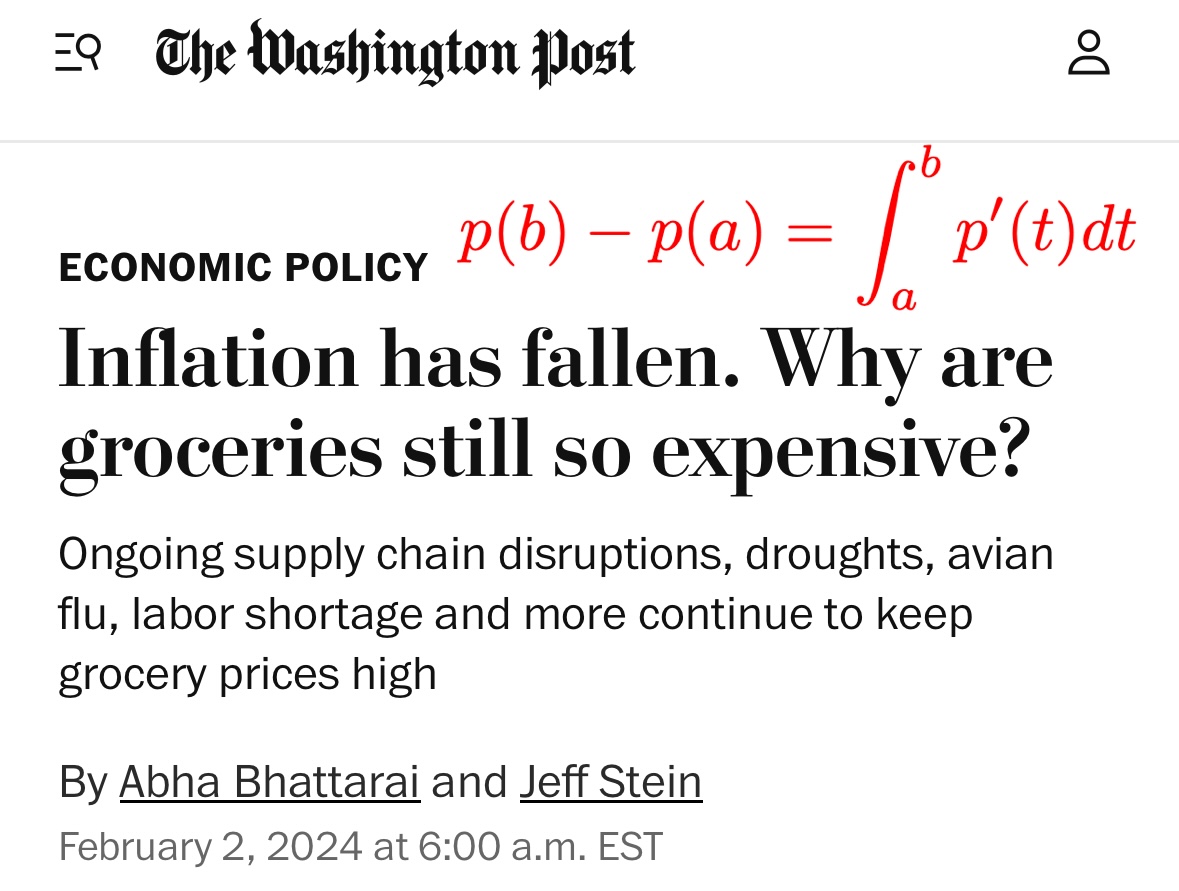

Good morning everybody. Last Friday, a headline from The Washington Post titled "Inflation has fallen. Why are groceries still so expensive?" made me irrationally angry. Not simply because of the extreme error in the title, but the fact that mainstream media publications and television outlets can get away with it:

Conflating the price level with inflation is a deliberate strategy by the global central banking cabal. An intentional misnomer used to trick those who don't know the difference into believing prices have fallen when they are still rising.

The "inflation has fallen" line is trotted out by politicians and media correspondents alike, trying to trick you into thinking that prices have fallen without giving the headline much thought. Yet in 60 years, prices have risen 10x and there has never been a period since the United States departed from the gold standard where prices have fallen for more than a month or two:

The difference between the price level and inflation is this.

Think back to precalculus. A car's speed is how we measure the rate of change of the car's position. If a car's speed is 60/mph, its position is changing by that much. In the same way, an item's inflation is how we measure the rate of change of the item's price. If an item's inflation is 2%/year, its price is rising by that much.

As long as the car's speed is positive, it is moving forward, even if your foot is off the gas pedal and it's cruising at 5/mph. In the same way, as long as an item's inflation is positive, it is getting more expensive, even if it is only at 2% annually.

A car's speed is to its position what an item's inflation is to its price.

Knowing this, saying "The car's speed has fallen. Why is the car still moving?" is just as absurd as saying "Inflation has fallen. Why are groceries still so expensive?"

The natural order of things is for prices to fall—the Federal Reserve combats this by enabling banks to lend new money into existence, without any reserves on hand needed to lend against. Translation: a bank could have $0 in cash reserves on hand, and extend $10,000 in new money into the economy through creating a loan or extending a line of credit. The Fed does this because according to modern monetary theory, prices need to always rise for the economy to function. The powers that be devalue your money every year because they think you would stop spending if you didn't; a completely insane assumption only econometrics are capable of.

Think of how much more productive you are today than you would have been 60 years ago thanks to modern technology, yet for all of this time and money saved with the entire world economy becoming infinitely more efficient, we are somehow spending more money for all of it.

We have forfeited our quality of life to ensure GDP growth is always positive, sacrificing our own livelihood and that of future generations so that economists can make their country more attractive on the global stage. Real productivity growth has been replaced with perpetual credit creation, no matter how bad the quality of borrowers is getting. It is a race to the bottom and you foot the bill, and they can only get away with it because they make sure you don't understand it.

They play this semantic game to distract you from the continuous and deliberate theft of your livelihood. The economists who write for the New York Times et al. ignore 9th-grade precalculus because the American electorate is innumerate at that level. Guess what? Now you understand, and they can't trick you anymore.

Arm yourself with information to take away their power.

Send this article to your friends and family so that they can understand the difference between prices and inflation.

Let's shift gears to a really quick market update.

In his latest interview with 60 Minutes, Fed Chair Jerome Powell shot down any chance of a March rate cut. He cites strong business activity as a reason not to loosen financial conditions just yet, with the fact that price inflation is still above its long-run target of 2% as an additional reason to not let up on attempting to tighten spending in the still-hot economy.

Our economy is influenced largely by forward expectations—if the expectation is that the cost of capital will decline in the near future, spending will accelerate, and a reversal of the downtrend in CPI inflation could follow. All of the progress in price inflation falling from 9.1% to 3.1% could be reversed with poor forward guidance alone. And as today's data signals, Powell was absolutely right to push back on the expectation for imminent rate cuts. ISM prices paid for January just shot up massively, from 57.4 to 64 versus the 56.7 expectation. This popular measure for prices paid by businesses leads CPI inflation by ~6 months. Good call by the Fed to take rate cuts off the table. It can't risk inflation reacceleration:

I wanted to keep it brief this Monday morning to make the message as meaningful and shareable as possible. Understand this: price inflation is entirely unnatural, and the people in charge get away with it because you don't know that. Read this article, then read it again and bookmark it, then share it with anybody who will listen. Their power comes from economic illiteracy, let's take it away from them.

Have an excellent Monday everybody,

Joe Consorti

Theya is an app for simplified Bitcoin self-custody. With its 2-of-3 multisig custody solution, you can enjoy maximum security for your Bitcoin and the peace of mind that comes with it.

Download Theya on the App Store and declare your sovereignty today.